[ad_1]

Our aim right here at Credible Operations, Inc., NMLS Quantity 1681276, known as “Credible” under, is to provide the instruments and confidence you could enhance your funds. Though we do promote merchandise from our associate lenders who compensate us for our providers, all opinions are our personal.

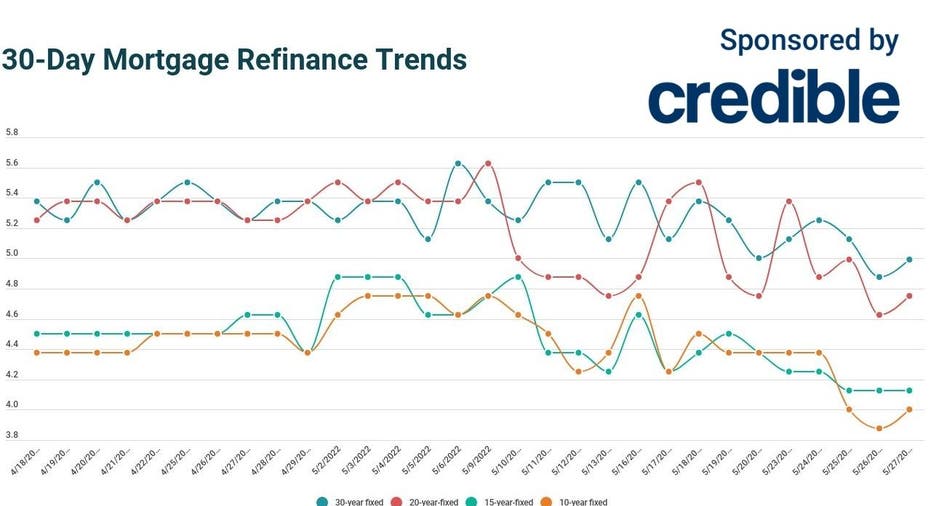

Try the mortgage refinancing charges for Could 27, 2022, that are largely up from yesterday. (Credible)

Primarily based on information compiled by Credible, mortgage refinance charges have risen for 3 key phrases and remained unchanged for one time period since yesterday.

Charges final up to date on Could 27, 2022. These charges are primarily based on the assumptions proven right here.

In the event you’re pondering of doing a cash-out refinance or refinancing your private home mortgage to decrease your rate of interest, think about using Credible. Credible’s free on-line instrument will allow you to examine charges from a number of mortgage lenders. You may see prequalified charges in as little as three minutes.

What this implies: After falling considerably yesterday, mortgage refinance charges are again up for 3 key phrases, with 30-year charges edging as much as slightly below 5%. In the meantime, 15-year charges have held regular for 3 straight days. This mid-length time period might supply the most effective alternative for a decrease price and manageable month-to-month fee. Owners who need to make dwelling enhancements can save extra on curiosity with a cash-out refinance than they might by funding these enhancements with bank cards or private loans.

WHAT IS CASH-OUT REFINANCING AND HOW DOES IT WORK?

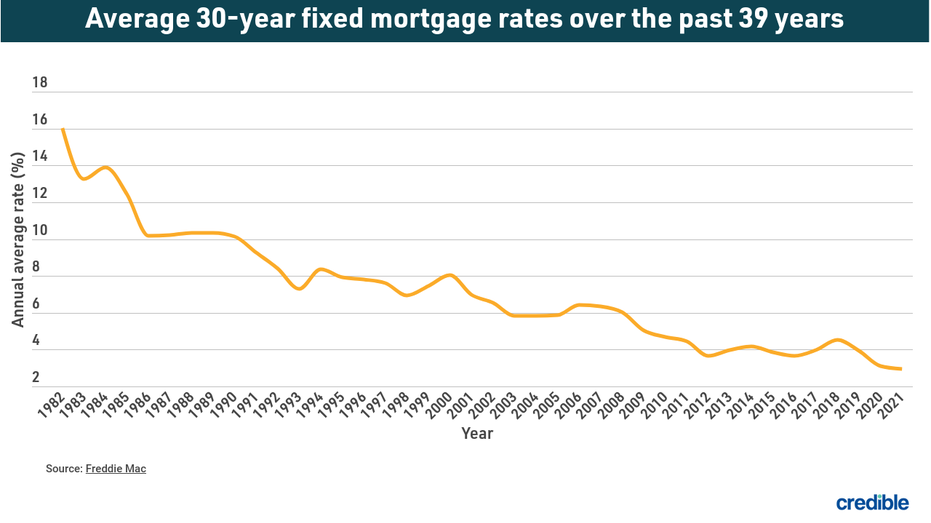

How mortgage charges have modified over time

Right this moment’s mortgage rates of interest are effectively under the very best annual common price recorded by Freddie Mac — 16.63% in 1981. A yr earlier than the COVID-19 pandemic upended economies the world over, the typical rate of interest for a 30-year fixed-rate mortgage for 2019 was 3.94%. The common price for 2021 was 2.96%, the bottom annual common in 30 years.

The historic drop in rates of interest means owners who’ve mortgages from 2019 and older may doubtlessly understand important curiosity financial savings by refinancing with one in every of immediately’s decrease rates of interest.

In the event you’re able to make the most of present mortgage refinance charges which are under common historic lows, you need to use Credible to examine charges from a number of lenders.

Tips on how to get your lowest mortgage refinance price

In the event you’re fascinated by refinancing your mortgage, bettering your credit score rating and paying down another debt may safe you a decrease price. It’s additionally a good suggestion to match charges from completely different lenders for those who’re hoping to refinance, so yow will discover the most effective price in your state of affairs.

Debtors can save $1,500 on common over the lifetime of their mortgage by purchasing for only one extra price quote, and a mean of $3,000 by evaluating 5 price quotes, based on analysis from Freddie Mac.

Make sure to store round and examine present mortgage charges from a number of mortgage lenders for those who determine to refinance your mortgage. You may do that simply with Credible’s free on-line instrument and see your prequalified charges in solely three minutes.

How does Credible calculate refinance charges?

Altering financial circumstances, central financial institution coverage selections, investor sentiment, and different elements affect the motion of mortgage refinance charges. Credible common mortgage refinance charges reported on this article are calculated primarily based on data offered by associate lenders who pay compensation to Credible.

The charges assume a borrower has a 740 credit score rating and is borrowing a standard mortgage for a single-family dwelling that will likely be their main residence. The charges additionally assume no (or very low) low cost factors and a down fee of 20%.

Credible mortgage refinance charges reported right here will solely provide you with an thought of present common charges. The speed you obtain can range primarily based on a lot of elements.

Assume it could be the suitable time to refinance? Make sure to store round and examine charges with a number of mortgage lenders. You may do that simply with Credible and see your prequalified charges in solely three minutes.

Are refinance charges greater than buy charges?

Refinance charges are typically greater than charges for brand spanking new mortgages to purchase a home. Listed below are some elements that affect the upper charges:

- Danger — A borrower who refinances right into a shorter time period to get a decrease rate of interest and repay their mortgage sooner might find yourself with a better month-to-month fee. That greater fee may translate into an elevated threat of default. Likewise, in cash-out refinances, the borrower’s debt-to-income ratio rises — and probably their threat of defaulting.

- Income — A lender might be able to earn more money off a purchase order mortgage than a refinance. Many homebuyers select longer phrases for buy mortgages, which include greater rates of interest. Refinancing right into a shorter time period and/or decrease rate of interest reduces the quantity of curiosity the lender makes over the lifetime of a mortgage.

- Prices — Refinancing a mortgage comes with most of the similar closing prices you’ll face once you take out a brand new mortgage, reminiscent of an appraisal, legal professional charges, and extra. Closing on a refinance additionally has prices for the lender. However whereas the decrease rate of interest and shorter time period you get with a refinance advantages you financially, the lender will make much less in curiosity over the lifetime of the refinanced mortgage.

- Your credit score — Hopefully, your credit score continues to enhance when you turn into a house owner. However that’s not all the time the case for everybody. A house owner whose credit score rating has truly fallen since they initially purchased the home might seem like a much bigger threat to lenders — who might cost a better rate of interest to offset the perceived threat.

Have a finance-related query, however do not know who to ask? E mail The Credible Cash Skilled at moneyexpert@credible.com and your query could be answered by Credible in our Cash Skilled column.

As a Credible authority on mortgages and private finance, Chris Jennings has lined matters that embrace mortgage loans, mortgage refinancing, and extra. He’s been an editor and editorial assistant within the on-line private finance house for 4 years. His work has been featured by MSN, AOL, Yahoo Finance, and extra.

[ad_2]

Source_link