[ad_1]

How one can purchase a home with no cash

A no down fee mortgage permits first-time residence consumers and repeat residence consumers to buy property with no cash required at closing, besides commonplace closing prices.

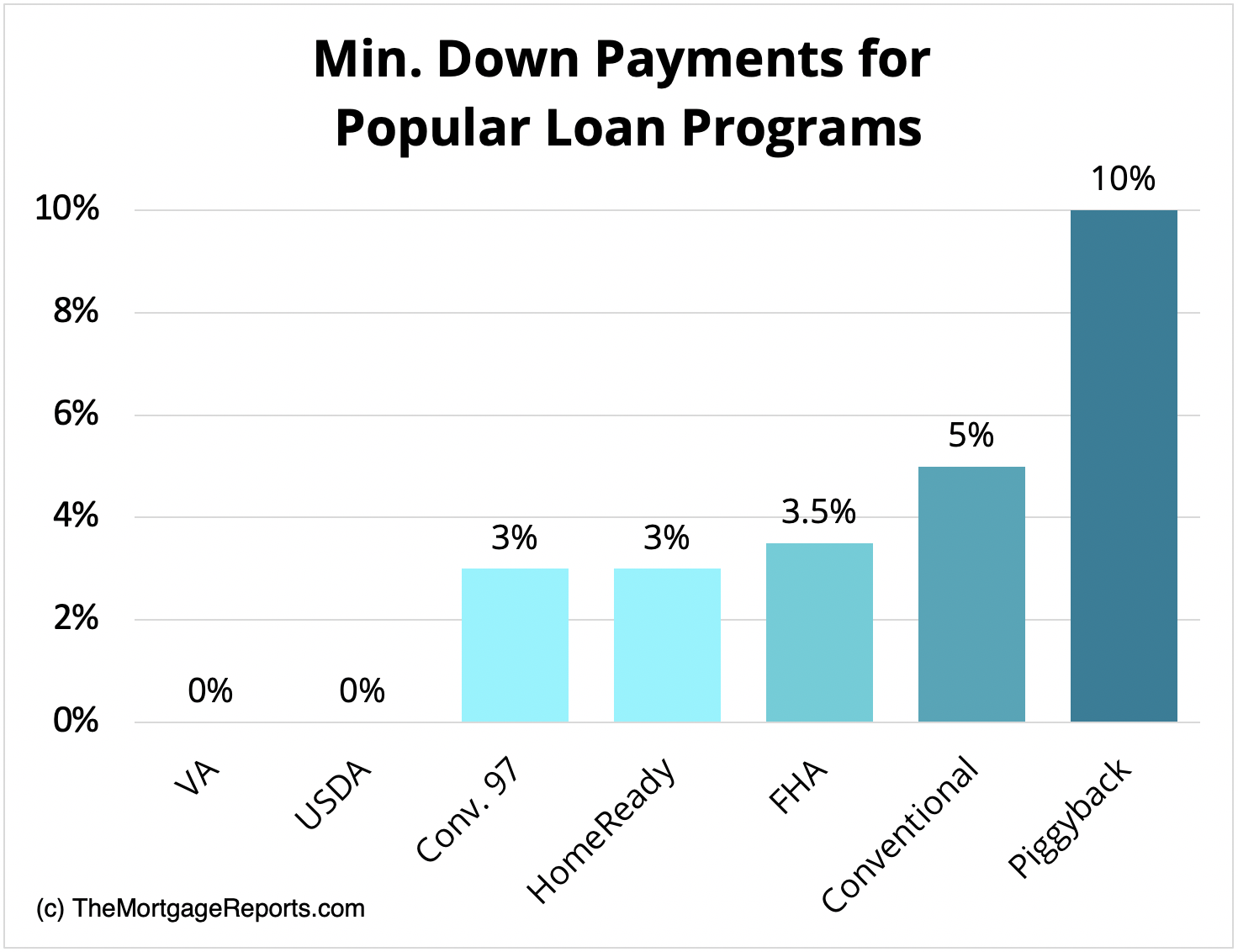

Different choices, together with the FHA mortgage, the HomeReady mortgage, and the Typical 97 mortgage, provide low down fee choices beginning at 3% down. Mortgage insurance coverage premiums sometimes accompany low and no down fee mortgages, however not all the time.

Thanks to those packages, residence consumers not have to save lots of for years to purchase a house. Many are prepared to purchase and easily don’t understand it but.

On this article (Skip to…)

Can you purchase a home with no cash down?

If you wish to purchase a home with no cash, there are two massive bills you’ll have to keep away from: the down fee and shutting prices. This can be potential when you qualify for a zero-down mortgage and/or a house purchaser help program.

5 methods to purchase a home with no cash embrace:

- Apply for a zero-down VA mortgage or USDA mortgage

- Use down fee help to cowl the down fee

- Ask for a down fee present from a member of the family

- Get the lender to pay your closing prices (“lender credit”)

- Get the vendor to pay your closing prices (“vendor concessions”)

When mixed, these techniques may put you in a brand new residence with $0 out of pocket.

Otherwise you may get your down fee coated, and you then’d solely have to pay closing prices out of pocket — which may cut back your money requirement by hundreds.

First-time residence purchaser loans with zero down

There are simply two main mortgage packages with zero down: the USDA mortgage and the VA mortgage. Each can be found to first-time residence consumers and repeat consumers alike. However they’ve particular eligibility necessities to qualify.

No down fee: USDA loans (100% financing)

The U.S. Division of Agriculture gives a 100% financing mortgage. This system is named the ‘Rural Housing Mortgage’ or just ‘USDA mortgage.’

The excellent news in regards to the USDA Rural Housing Mortgage is that it’s not only a “rural mortgage” — it’s accessible to consumers in suburban neighborhoods, too. The USDA’s purpose is to assist “low-to-moderate earnings homebuyers” throughout a lot of the U.S., excluding main cities.

Many debtors utilizing the USDA mortgage program make a superb dwelling and reside in neighborhoods that don’t meet the standard definition of a ‘rural space.’

Some key advantages of the USDA mortgage are:

- No down fee requirement

- No most residence buy value

- Beneath-market rates of interest

- The upfront assure charge will be added to the mortgage steadiness at closing

- Month-to-month mortgage insurance coverage charges are cheaper than for FHA

Simply bear in mind that USDA enforces earnings limits; your family earnings should be close to or under the median to your space.

One other key profit is that USDA mortgage charges are sometimes decrease than charges for comparable low- or no-down-payment mortgages. Financing a house through USDA will be the lowest-cost path to homeownership.

No down fee: VA loans (100% financing)

The VA mortgage is a no-down-payment mortgage accessible to members of the U.S. army, veterans, and surviving spouses.

VA loans are backed by the U.S. Division of Veterans Affairs. Which means they’ve decrease charges and simpler necessities for debtors who meet VA mortgage tips.

VA mortgage {qualifications} are simple.

Most veterans, active-duty service members, and honorably discharged service personnel are eligible for the VA program. As well as, residence consumers who’ve spent at the least 6 years within the Reserves or Nationwide Guard are eligible, as are spouses of service members killed within the line of responsibility.

Some key advantages of the VA mortgage are:

- No down fee requirement

- Versatile credit score rating minimums

- Beneath-market mortgage charges

- Chapter and different derogatory credit score info doesn’t instantly disqualify you

- No mortgage insurance coverage is required, solely a one-time funding charge which will be included within the mortgage quantity

As well as, VA loans haven’t any most mortgage quantity. It’s potential to get a VA mortgage above present conforming mortgage limits, so long as you may have sturdy sufficient credit score and you may afford the funds.

Low down fee first-time residence purchaser loans

Not everybody will qualify for a zero-down mortgage. However it could nonetheless be potential to purchase a home with no cash down by selecting a low-down-payment mortgage and utilizing an help program to cowl your upfront prices.

If you wish to go this route, listed below are a number of of the perfect low-money-down mortgages to contemplate.

Low down fee: FHA loans (3.5% down)

The ‘FHA mortgage’ is a little bit of a misnomer as a result of the Federal Housing Administration (FHA) doesn’t truly lend cash.

Relatively, the FHA units primary lending necessities and insures these loans as soon as they’re made. The loans themselves are supplied by practically all non-public mortgage lenders.

FHA mortgage tips are well-known for his or her liberal strategy to credit score scores and down funds.

The FHA will sometimes insure residence loans for debtors with low credit score scores, as long as there’s an affordable clarification for the low FICO.

FHA additionally permits a down fee of simply 3.5% in all U.S. markets, aside from a number of FHA authorized condos.

Different advantages of an FHA mortgage are:

- Your down fee could come solely from present funds or down fee help

- The minimal credit score rating is 500 with a ten% down fee, or 580 with a 3.5% down fee

- Upfront mortgage insurance coverage premiums will be included within the mortgage quantity

Moreover, the FHA can generally assist householders who’ve skilled latest quick gross sales, foreclosures, or bankruptcies.

The FHA insures mortgage sizes as much as $ in designated “high-cost” areas nationwide. Excessive-cost areas embrace locations like Orange County, California; the Washington D.C. metro space; and, New York Metropolis’s 5 boroughs.

Be aware that if you wish to use an FHA mortgage, the house being bought should be your main residence. This program isn’t supposed for trip houses or funding properties.

Low down fee: HomeReady/Dwelling Attainable (3% down)

The HomeReady mortgage is particular amongst right this moment’s low- and no-down-payment mortgages.

Backed by Fannie Mae and accessible from practically each U.S. lender, the HomeReady mortgage gives below-market mortgage charges, diminished non-public mortgage insurance coverage (PMI) prices, and revolutionary underwriting for lower-income residence consumers.

As an example, the HomeReady program permits you to use boarder earnings to assist qualify, and you need to use earnings from a non-zoned rental unit, too — even when you’re paid in money.

HomeReady residence loans have been designed to assist multi-generational households get authorized for mortgage financing. Nonetheless, this system can be utilized by anybody in a qualifying space, or who meets family earnings necessities.

Freddie Mac gives the same program, known as Dwelling Attainable, which can also be value a glance.

Dwelling Attainable is rather less versatile about earnings qualification than HomeReady. However it gives many comparable advantages, together with a minimal 3% down fee.

Low down fee: Typical mortgage 97 (3% down)

The Typical 97 program is accessible from Fannie Mae and Freddie Mac. It’s a 3% down fee program and, for a lot of residence consumers, it’s a inexpensive mortgage possibility than an FHA mortgage.

Primary qualification necessities for a Typical 97 mortgage embrace:

- Mortgage measurement could not exceed $, even when the house is in a high-cost market

- The property should be a single-unit dwelling. No multi-unit houses are allowed

- The mortgage should be a fixed-rate mortgage. No adjustable-rate mortgages are allowed through the Typical 97

The Typical 97 program doesn’t implement a selected minimal credit score rating past these for a typical standard residence mortgage. This system can be utilized to refinance a house mortgage, too.

As well as, the Typical 97 mortgage permits for the complete 3% down fee to come back from gifted funds, as long as the gifter is expounded by blood or marriage, authorized guardianship, home partnership, or is a fiance/fiancee.

Low down fee: Typical mortgage (5% down)

Typical 97 loans are just a little extra restrictive than ‘commonplace’ standard loans, as a result of they’re supposed for first-time residence consumers who want further assist qualifying.

When you don’t meet the rules for a Typical 97 mortgage, it can save you up just a little extra and take a look at for the standard standard mortgage.

Typical mortgages are the preferred mortgage kind available in the market as a result of they’re extremely versatile. You can also make a down fee as little as 5% or as massive as 20% or extra. And also you solely want a 620 credit score rating to qualify in lots of circumstances.

Plus, standard mortgage limits are greater than FHA mortgage limits. So in case your buy value exceeds FHA’s restrict, you may need to save up 5% and take a look at for a traditional mortgage as an alternative.

Typical mortgages with lower than 20% down require non-public mortgage insurance coverage (PMI). However this may be canceled after getting 20 % fairness within the residence. So that you’re not caught with the extra charge perpetually.

Low down fee: The “Piggyback Mortgage” (10% down)

One last possibility if you wish to put lower than 20% down on a home — however don’t need to pay mortgage insurance coverage — is a piggyback mortgage.

The “piggyback mortgage” or “80/10/10” program is often reserved for consumers with above-average credit score scores. It’s truly two loans, meant to offer residence consumers added flexibility and decrease general funds.

The fantastic thing about the 80/10/10 is its construction.

- With an 80/10/10 mortgage, consumers convey a ten% down fee to closing

- Additionally they get a ten% second mortgage (HEL or HELOC)

- This leaves an 80% mortgage mortgage

- Because you’re successfully placing 20% down, there is no such thing as a PMI

The primary mortgage is often a traditional mortgage through Fannie Mae or Freddie Mac, and it’s supplied at present market mortgage charges.

The second mortgage is a mortgage for 10% of the house’s buy value. This mortgage is often a house fairness mortgage (HEL) or residence fairness line of credit score (HELOC).

And that leaves the final “10,” which represents the client’s down fee quantity — 10% of the acquisition value. This quantity is paid as money at closing.

This sort of mortgage construction can assist you keep away from non-public mortgage insurance coverage, decrease your month-to-month mortgage funds, or keep away from a jumbo mortgage when you’re proper on the cusp of conforming mortgage limits.

Nonetheless, you’ll sometimes want a credit score rating of 680-700 or greater to qualify for the second mortgage. And also you’ll have two month-to-month funds as an alternative of 1.

When you’re involved in a piggyback mortgage, talk about pricing and eligibility with a lender. Ensure you’re getting essentially the most inexpensive residence mortgage general — month-to-month and in the long run.

Dwelling consumers don’t have to put 20% down

It’s a standard false impression that “20 % down” is required to purchase a house. And, whereas which will have true in some unspecified time in the future in historical past, it hasn’t been so because the introduction of the FHA mortgage in 1934.

In right this moment’s actual property market, residence consumers don’t have to make a 20% down fee. Many consider that they do, nevertheless — regardless of the plain dangers.

The possible motive consumers consider 20% down is required is as a result of, with out 20 %, you’ll need to pay for mortgage insurance coverage. However that’s not essentially a nasty factor.

PMI shouldn’t be evil

Personal mortgage insurance coverage (PMI) is neither good nor unhealthy, however many residence consumers nonetheless attempt to keep away from it in any respect prices.

The aim of personal mortgage insurance coverage is to guard the lender within the occasion of foreclosures — that’s all it’s for. Nonetheless, as a result of it prices householders cash, PMI will get a nasty rap.

It shouldn’t.

Due to non-public mortgage insurance coverage, residence consumers can get mortgage-approved with lower than 20% down. And, finally, non-public mortgage insurance coverage will be eliminated.

On the charge right this moment’s residence values are growing, a purchaser placing 3% down may pay PMI for fewer than 4 years.

That’s not lengthy in any respect. But many consumers — particularly first-timers — will postpone a purchase order as a result of they need to save up 20 %.

In the meantime, residence values are climbing.

For right this moment’s residence consumers, the scale of the down fee shouldn’t be the one consideration.

It is because residence affordability shouldn’t be in regards to the measurement of your down fee — it’s about whether or not you’ll be able to handle the month-to-month funds and nonetheless have money left over for “life.”

A big down fee will decrease your mortgage quantity, and due to this fact provides you with a smaller month-to-month mortgage fee. Nonetheless, when you’ve depleted your life financial savings to be able to make that giant down fee, you’ve put your self in danger.

Don’t deplete your whole financial savings

When the vast majority of your cash is tied up in a house, monetary consultants discuss with it as being “house-poor.”

Once you’re house-poor, you may have loads of cash on paper however little money accessible for on a regular basis dwelling bills and emergencies.

And, as each home-owner will let you know, emergencies occur.

Roofs collapse, water heaters break, you change into ailing and can’t work. Insurance coverage can assist you with these points generally, however not all the time.

That’s why being house-poor is so harmful.

Many individuals consider it’s financially conservative to place 20% down on a house. If 20% is all of the financial savings you may have, although, utilizing the complete quantity for a down fee is the alternative of being financially conservative.

The true financially conservative possibility is to make a small down fee and go away your self with some cash within the financial institution. Being house-poor isn’t any technique to dwell.

Mortgage down fee FAQ

Listed here are solutions to among the most steadily requested questions on mortgage down funds.

The minimal down fee varies by mortgage program. VA and USDA loans permit zero down fee. Typical loans begin at 3 % down. And FHA loans require at the least 3.5 % down. You might be free to contribute greater than the minimal down fee quantity if you need.

There are simply two first-time residence purchaser loans with zero down. These are the VA mortgage (backed by the U.S. Division of Veterans Affairs) and the USDA mortgage (backed by the U.S. Division of Agriculture). Eligible debtors can purchase a home with no cash down however will nonetheless need to pay for closing prices.

There are two methods to purchase a home with no cash down. One is to get a zero-down USDA or VA mortgage when you qualify. The opposite is to get a low-down-payment mortgage and canopy your upfront price utilizing a down fee help program. FHA and standard loans can be found with simply 3 or 3.5 % down, and that whole quantity may come from down fee help or a money present.

The no-money-down USDA mortgage program sometimes requires a credit score rating of at the least 640. One other no-money-down mortgage, the VA mortgage, permits credit score scores as little as 580-620. However you should be a veteran or service member to qualify.

Down fee help packages can be found to residence consumers nationwide, and plenty of first-time residence consumers are eligible. DPA can come within the type of a house purchaser grant or a mortgage that covers your down fee and/or closing prices. Packages differ by state, so you should definitely ask your mortgage lender which packages chances are you’ll be eligible for.

Dwelling purchaser grants are supplied in each state, and all U.S. residence consumers can apply. These are often known as down fee help (DPA) packages. DPA packages are broadly accessible however seldom used — many residence consumers don’t know they exist. Eligibility necessities sometimes embrace having low earnings and a good credit score rating. However tips differ lots by program.

Sure, money presents can be utilized for a down fee on a house. However you need to observe your lender’s procedures when receiving a money present. First, be sure that the present is made utilizing a private test, a cashier’s test, or a wire. Second, maintain paper information of the present, together with photocopies of the checks and of your deposit to the financial institution. And ensure your deposit matches the quantity of the present precisely. Your lender may even need to confirm that the present is definitely a present and never a mortgage in disguise. Money presents should not require compensation.

FHA loans sometimes require a credit score rating of 580 or greater and a 3.5 % minimal down fee. Additionally, you will want a secure earnings and two-year employment historical past verified by W-2 statements and paystubs, or by federal tax returns if self-employed. The house you’re buying should be a main residence with 1-4 models that passes an FHA residence appraisal. And your mortgage quantity can not exceed native FHA mortgage limits. Lastly, you can not have a latest chapter, foreclosures, or quick sale.

Simply as there are advantages to low- and no-money-down mortgages, there are advantages to placing extra money down on a house buy. For instance, extra money down means a smaller mortgage quantity — which reduces your month-to-month mortgage fee. Moreover, in case your mortgage requires mortgage insurance coverage, with extra money down, your mortgage insurance coverage will probably be eliminated in fewer years.

Mortgage insurance coverage is often required with lower than 20 % down, however not all the time. For instance, the VA Dwelling Mortgage Warranty program doesn’t require mortgage insurance coverage, so making a low down fee received’t matter. Conversely, FHA and USDA loans all the time require mortgage insurance coverage. So even with massive down funds, you’ll have a month-to-month MI cost. The one mortgage for which your down fee quantity impacts your mortgage insurance coverage is the standard mortgage. The smaller your down fee, the upper your month-to-month PMI. Nonetheless, as soon as your private home has 20 % fairness, you’ll be eligible to have your PMI eliminated.

Lender charges are sometimes decided as a proportion of your mortgage quantity. As an example, the mortgage origination charge may be 1 % of your mortgage steadiness. The larger your down fee, the decrease your mortgage quantity will probably be. So placing extra money down can assist decrease your lender charges. However you’ll nonetheless need to convey additional cash to the closing desk within the type of a down fee.

A few of the extra frequent methods to fund a down fee are to make use of your financial savings or checking account, or, for repeat consumers, the proceeds from the sale of your current residence. Different methods to fund a down fee embrace utilizing a money present or borrowing from a 401k or IRA (though that’s typically not beneficial). Down fee help packages can fund a down fee, too. DPAs lend or grant cash to residence consumers with the stipulation that they dwell within the residence for a sure variety of years — typically 5 years or longer.

The reply to the query ‘How a lot residence can I afford?’ is a private one and shouldn’t be left solely to your mortgage lender. One of the best ways to find out how a lot home you’ll be able to afford is to start out together with your month-to-month price range and determine what you’ll be able to comfortably pay for a house every month. Then, utilizing your required fee as the place to begin, use a mortgage calculator and work backward to seek out your most residence buy value.

What are right this moment’s low-down-payment mortgage charges?

Mortgage charges have risen from their all-time lows. However the excellent news is, many low-down-payment mortgages have below-market charges because of their authorities backing; these embrace FHA loans (3.5% down) and VA and USDA loans (0% down).

Completely different lenders provide totally different charges, so that you’ll need to examine a number of mortgage gives to seek out the perfect deal in your low- or no-down-payment mortgage. You will get began proper right here.

The data contained on The Mortgage Studies web site is for informational functions solely and isn’t an commercial for merchandise supplied by Full Beaker. The views and opinions expressed herein are these of the writer and don’t replicate the coverage or place of Full Beaker, its officers, father or mother, or associates.

[ad_2]

Source_link