[ad_1]

In our consumer communication, I’ve been occupied with why the market ought to get well based mostly on fundamentals.

Finally, folks have to have religion that enterprise will survive and thrive and in proudly owning a basket of shares or bonds, you personal belongings which have sound financial drivers. If you happen to personal bonds, you’re a lender and the debt issuer pays you a coupon. If you happen to personal shares, you personal a stake within the enterprise’s future money stream and the enterprise will return to you in dividends or go up in worth.

The query could be how a lot we’re keen to pay for a basket of those companies.

If we pay a comparatively pricey worth and the longer term outlook of those companies doesn’t look as nice as we anticipate, then we do not need a lot margin of security. We might be basically paying $2 for what’s value $2.2. Not a superb end result. Maybe we have been mistaken that the longer term truly appears to be like brighter and it’s value $2.80, in that case, it’s extra value it.

At present, Mr Market gave the impression to be implying that if we purchase right now, we’re paying way more for one thing that’s nugatory and we’re adjusting downwards.

However in the end, the basket of enterprise as a complete ought to pay us again in money stream and curiosity funds. If this precept is violated, then it doesn’t make sense to spend money on shares and bonds.

What may go out for us is that basically, the long run money flows of those companies mustn’t deviate that a lot as a collective.

We are able to debate that based mostly on the discounted money flows of this basket of enterprise that they could be value $2.20 to $2.80 but when we’re capable of purchase them fairly at $2.00… we aren’t tremendous positive however we’re paying an honest worth for these companies.

A easy method to worth a basket of shares that belong to an index is to take a look at its historic price-earnings or its ahead worth earnings. The upper the value earnings, the dearer the basket of shares and in a method the longer it could be wanted for us to make again our cash. However it could additionally indicate that this basket of shares is of upper high quality.

Thus, price-earnings indicate a variety of issues and it’s not a matter of whether or not low PE is reasonable and higher or excessive PE isn’t good.

Most would perceive if we invert PE and get the ahead or historic earnings yield. For instance, presently, the ahead PE (based mostly on ahead forecasted earnings per share of the basket of shares) is nineteen.5 occasions.

This suggests an earnings yield of 1/19.5 = 5.1%.

5.1% and the expansion charge of this basket of shares is one thing that you need to use to match to different investments.

If the PE is 14 occasions, the earnings yield is 7.1%.

The value of the basket of shares can go up or down, the earnings can go up or down as nicely. However taken collectively, a evaluate of PE and earnings yield, relative to historical past may give us an concept of whether or not this basket of shares which can be ever-changing within the index is lean in direction of cheaper or dearer.

If the PE will get all the way down to 10 occasions, the earnings yield is 10% which might be very enticing relative to historical past and folks will bid up for it. And that won’t have factored sooner or later development of the earnings.

You’re going to get a PE growth and the market worth regulate upwards as folks bid up a basket of enterprise that is ready to assist them hedge their inflation dangers.

The alternative is true as nicely.

If the PE is 25 occasions, the earnings yield will get to 4%. If future development has reached a peak (which means earnings have been rising a lot up to now years that it has to pause or decline sooner or later), this makes the basket of shares look comparatively costly if the risk-free treasury moved as much as 3% a yr.

There isn’t a incentive to carry this basket of shares relative to the risk-free treasury. That is why this charge transfer up is troublesome for shares.

The market consistently reprices the price of this basket of shares.

A Evaluate of the PE of the Market

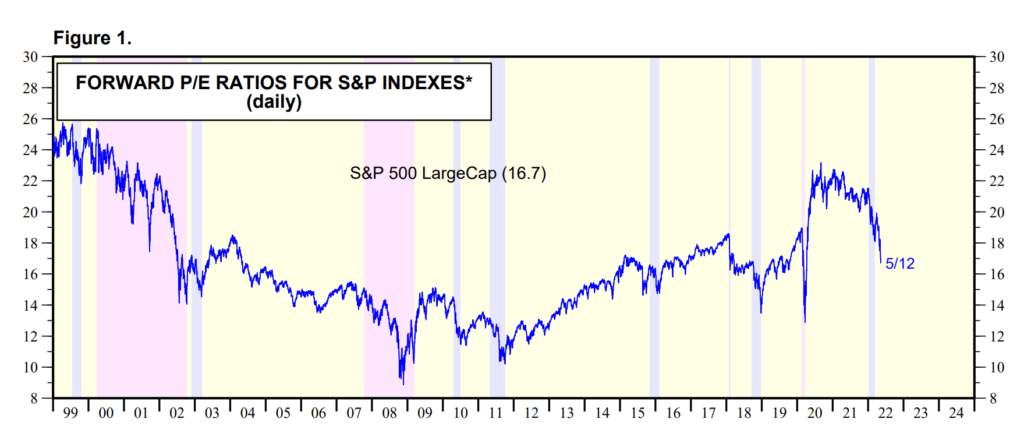

Edward Yardeni at Yardeni Analysis consistently publishes a report on the ahead and historic PE ratio.

If you happen to Google “Yardeni PE Ratio”, it is best to hit a PDF that offers you a report that reveals the place the PE ratio comparatively to historical past.

So the place are we now that the costs have fallen by roughly 17%? Allow us to check out the S&P 500, which varieties 60-65% of the MSCI World.

The yellow shaded areas present bull markets, the pink present bear market (20% correction and above) and the blue space present correction between 10-20%.

At its peak in 2020, the ahead PE didn’t attain the peak of dotcom. Nonetheless, there are numerous tales that we will inform from this knowledge.

We are able to see how lengthy it took for the PE to compress from the peak in 1999. The PE principally compressed for like 12 years earlier than the PE expanded. PE compressed because of the worth falling or earnings growing over time, or a combination of each.

The PE principally compressed via the 2000 to 2002 bear, then the following restoration, then the GFC bear in addition to the restoration after that earlier than increasing in 2011.

If we draw a line from 2007 to 2012, the PE then is about 12 occasions or if we invert it the earnings yield was 8.3%. If you happen to can purchase a basket of high-quality blue-chip companies that self rejuvenates for 8.3%, with the potential for growing earnings development that appears very enticing.

You might be able to perceive why the US market ran so nicely from 2010 to the place it’s presently.

Quantitative easing does assist (loads), however the enterprise must earn nicely for this development to maintain.

At present, Yardeni has the bigger capitalization firms at 16.7 occasions or 5.9% earnings yield. They’ve undoubtedly compressed a good bit and appear like we’re again to 2017, 2019, and 2003 ranges.

The distinction between right now’s and the dot-com interval is that these bigger companies are additionally throwing out a variety of money flows. The query is what occurs when liquidity is taken away.

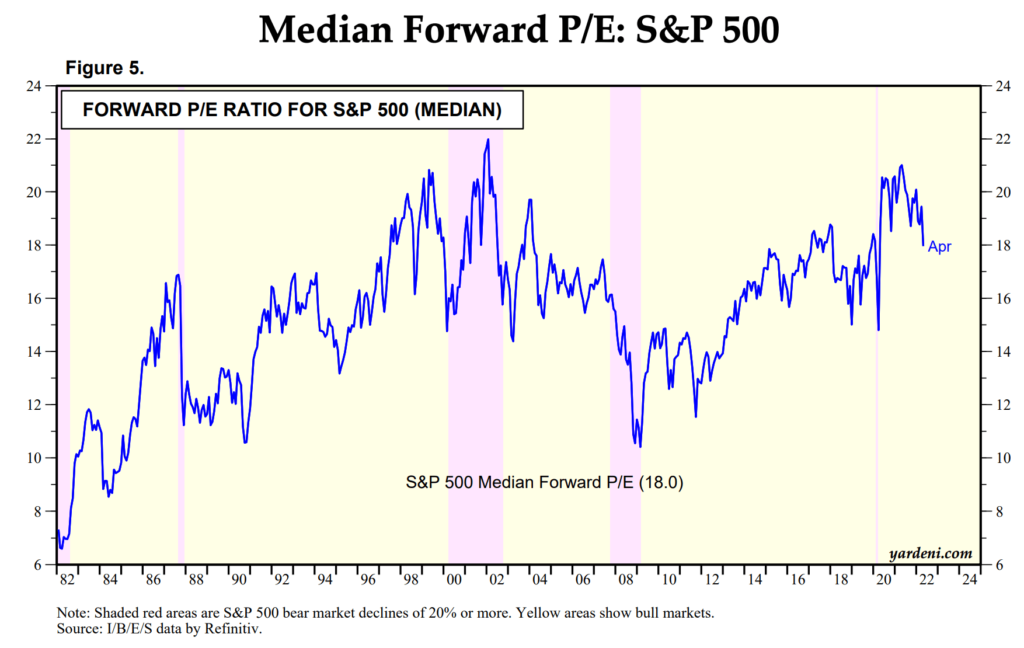

Yardeni additionally introduced a chart exhibiting the median ahead PE of the S&P 500 and likewise over an extended timeframe ranging from 1982 as an alternative of 1998. Median ahead PE ought to present the PE based mostly on the agency in the midst of the S&P 500, which ought to take away the contribution of the bigger capitalization companies.

The PE is eighteen occasions, increased than the large-cap. This tells me that if we take out the bigger companies within the S&P 500, the smaller companies are both dearer or they don’t have pretty much as good earnings as the most important companies.

On this regard, we’re nonetheless fairly removed from the typical from 1992 to 2022 of about 16 occasions. The common firm could need to fall 12.5% extra from present ranges earlier than issues grow to be honest.

It is usually sort of loopy how low the PE was initially of the secular 1982 bull and the place it ended on the 2000. PE expanded from 7 to 22.

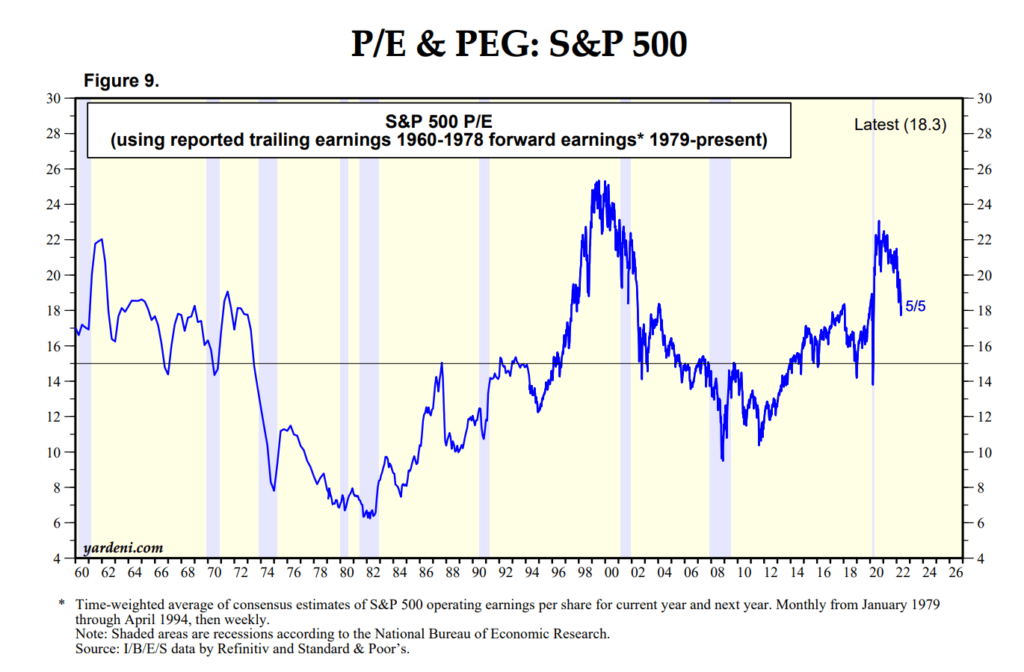

Yardeni constructed a fair longer PE chart going again to 1960 and that will issue within the excessive inflation interval.

The worrying factor is that the risk-free charge acquired as much as a really excessive share of 10-14% and to ensure that the shares to look enticing, the earnings need to develop like loopy and costs need to drop a good bit.

A PE of seven occasions is a 15% earnings yield, which supplies us an concept that rates of interest do affect threat belongings.

The Cheapness of the Smaller US Corporations

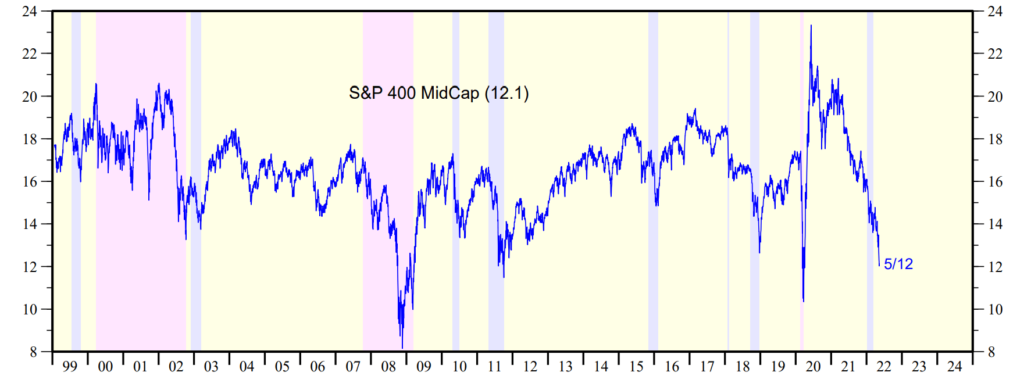

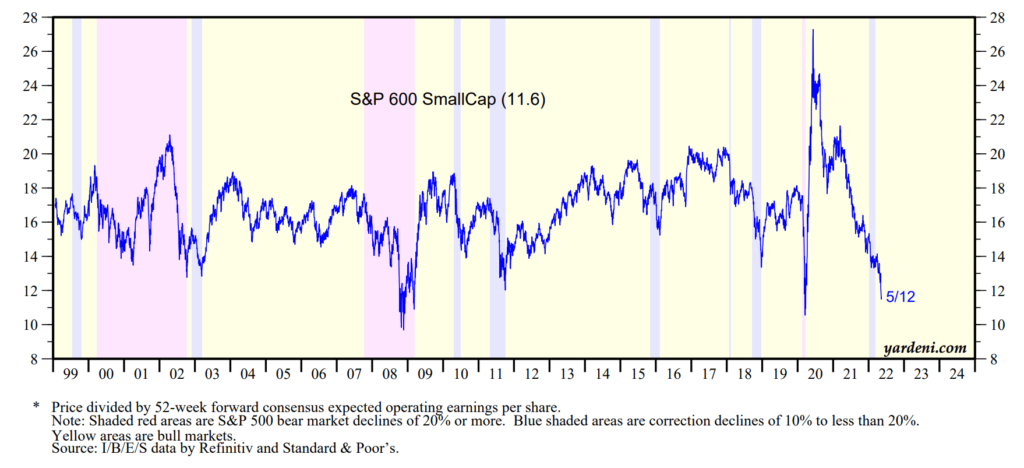

The chart above reveals the PE of the medium-capitalization firms within the US, relative to the historical past.

Mid Cap firms are fairly huge. They’re not less than 7-11 billion.

We are able to see that the chart appears to be like fairly totally different from the large-cap one.

It appears to be like like it’s oscillating extra not between excessive extremes however there appears to be a imply of round 16 occasions PE or 6.2% earnings yield.

If it goes above 16 occasions finally it corrects downwards and if it goes under that, it reverses upwards. The query is how lengthy it takes.

At present, the PE is 12.1 occasions or 8.2% earnings yield. That is decrease than the bottom in 2002 however not as dangerous as 2008. Fairly near Covid and 2018 lows.

I believe it’s low cost sufficient.

Factoring in ahead earnings, the small-cap are low cost.

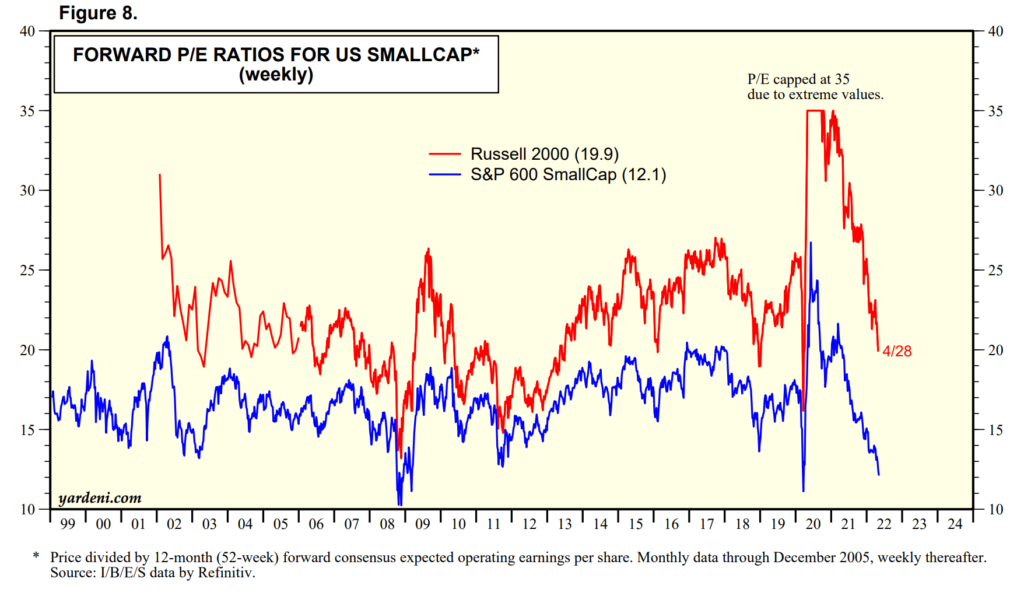

It ought to be famous that there’s a distinction between S&P 600 SmallCap and the Russell 2000 index in that S&P think about including companies which have earnings and different standards so I might anticipate the PE chart of a Russell 2000 index to look fairly totally different.

This chart ought to provide you with a greater concept.

The PE of the Russell 2000 index at all times appears to be like increased than the S&P 600. That is bizarre to me as a result of if the companies are increased high quality, I might have thought they need to commerce at the next valuation on common.

However you may see how loopy the PE of Russell 2000 acquired. Yardeni needed to cap the PE to 35 occasions on account of excessive values. It’s even increased than the 2002 interval. Even with the correction, its not as little as the 2008 and Covid bottoms, not like the S&P 600 SmallCap.

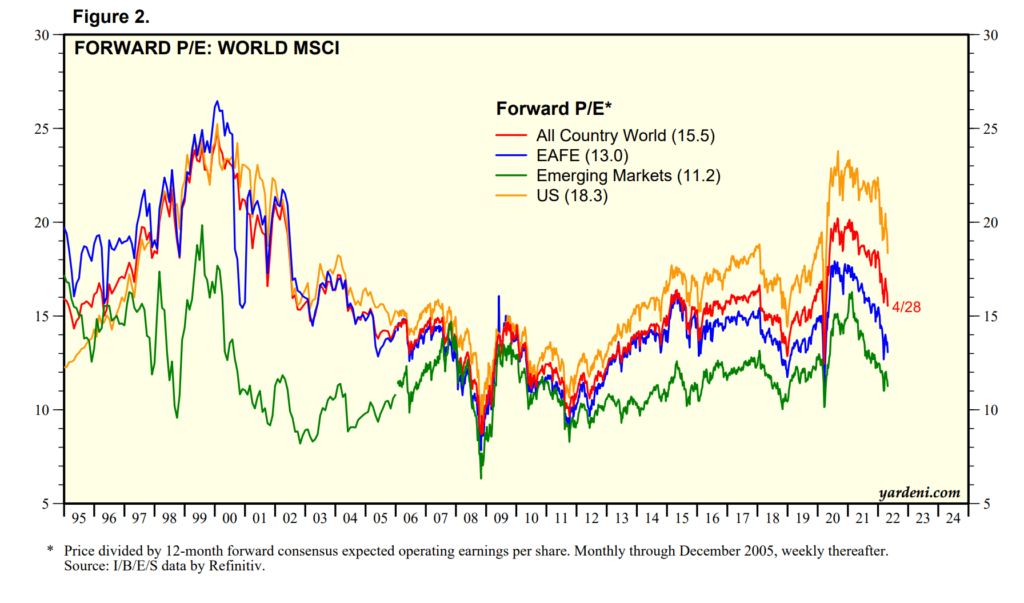

The World Relative to the US

The world relative to the US is cheaper.

One factor I seen is that inside every line, there may be some form of imply reversion, however for the previous 10 years, the US has been extra proof against it.

Conclusion

If there may be one factor that we study, it’s that markets have an extended historical past and it gyrates between durations of cheaper, much less low cost, costly, and really costly.

If you don’t want to purchase issues which can be too costly or want to discover alternatives the place issues are extra attractively valued, but with fundamentals that held up, then maybe it’s to seek for alternatives not within the large-cap firms.

You don’t need to play the identical sport because the MSCI World or S&P 500.

There appears to be a worth premium there to be captured. How do you seize the worth premium?

Both prospect cheaper firms that you just suppose are mispriced and purchase them as a basket, or spend money on a price fund.

Or you can spend money on a value-tilted exchange-traded fund.

If you happen to learn my article on Good Beta ETF, now we have the chance to spend money on the cheaper firms.

The MSCI World Worth UCITS ETF (IWVL) presently trades at a trailing PE (utilizing the final 12 month’s earnings not ahead) of 9.4 occasions, in comparison with a PE of 17 occasions for the MSCI World ETF (SWDA).

Even the MSCI World Multifactor UCITS ETF (IFSW) trades at a PE of 11.3 occasions.

So the world is open in case your funding philosophy is totally different.

If you happen to’re seeking to commerce these shares I’ve talked about, you may open an account with Interactive Brokers. Interactive Brokers is the primary low-cost and environment friendly dealer I exploit and belief to take a position & commerce my holdings in Singapore, the USA, London Inventory Alternate and Hong Kong Inventory Alternate. They can help you commerce shares, ETFs, choices, futures, foreign exchange, bonds and funds worldwide from a single built-in account.

You possibly can learn extra about my ideas about Interactive Brokers in this Interactive Brokers Deep Dive Sequence beginning with find out how to simply create & fund your Interactive Brokers account.

[ad_2]

Source_link